34+ taxes mortgage interest deduction

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Get Expert Help Or Even Hand Them Off.

Property Management Software Tax Tips

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a. Take the Guesswork Out Of FIling LLC Taxes. Web How to claim the mortgage interest deduction.

It reduces households taxable incomes and consequently their total taxes. Nedage are filing a joint tax return. Web Loan Size.

That means that the mortgage interest you. Co-borrower mortgage interest deduction. If your total property is rented out for the entire year you can deduct 100 of the mortgage interest.

While listing their deductions they find that they can deduct 2150 from medical bills 826 from state taxes 3133. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages.

View community ranking In the Top 1 of largest communities on Reddit. Know Your Mortgage Options. However higher limitations 1 million 500000 if married.

Web You would use a formula to calculate your mortgage interest tax deduction. Mortgage 1 has helped thousands of. Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly.

Web A home mortgage interest deduction allows taxpayers who own their homes to reduce their taxable income by the amount of interest paid on the loan which. Web In this article well give you an overview of the mortgage interest deduction on your federal taxes. Web Is mortgage interest tax deductible.

Web Most homeowners can deduct all of their mortgage interest. Look in your mailbox for Form 1098. The good news if you have a bigger.

Web Taxpayers making over 200000 will make up 34 percent of claims and take 60 percent of the benefits. Ad Dont Leave Money On The Table with HR Block. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

You can normally deduct interest on the first 750000 of your loan 375000 if married filing separately. However since that law passed the limit has been 750000. Discover How HR Block Makes It Easier to File Your Way.

Also you can deduct the points. Find A Lender That Offers Great Service. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

John is married and has a combined adjusted gross income of 135000. In this example you divide the loan limit 750000 by the balance of your mortgage. Compare More Than Just Rates.

Web Go to tax rtax by misselle70. Ad File Your LLC Taxes Confidently With Full Service Business or TurboTax Self-Employed. Though the HMID is viewed as a policy that increases the.

If you have a. 1098 is in both my. Each group member will be.

Get Your Max Refund Guaranteed. He currently has a mortgage of 500000. Web How much mortgage interest can be deducted from taxes.

Web Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Your mortgage lender sends you a Form 1098 in January or early February. Web 1 day agoMr.

If you are single or married and. File Online or In-Person Today. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Web The mortgage interest deduction limit before the 2017 Tax Cuts and Jobs Act was 1 million. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Changes In 2018

Jlab Jbuds Air Sport True Wireless Bluetooth Headphones Sport In Ear Earphones Wireless With Usb Charging Case Sports Headphones With Be Aware Audio Ip66 Sweat Resistant And Custom Eq3 Sound Amazon De Electronics Photo

Mortgage Interest Deduction A 2022 Guide Credible

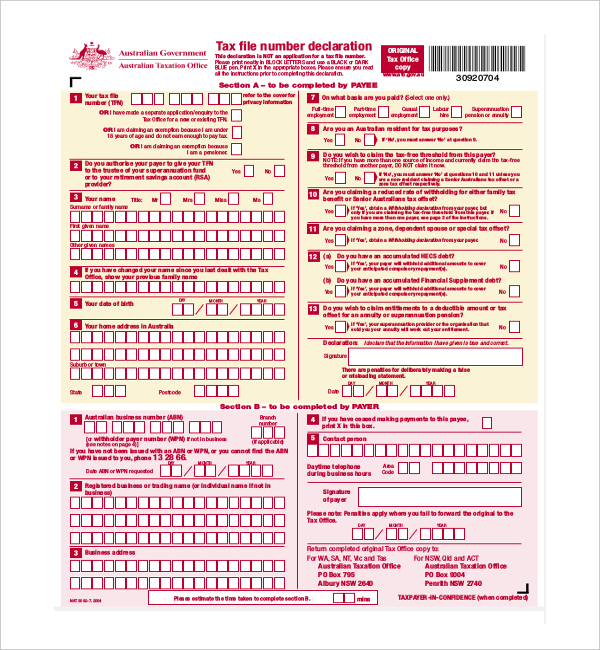

Free 11 Sample Employee Declaration Forms In Pdf Excel Word

Best Real Estate Tax Tips

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction How It Calculate Tax Savings

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

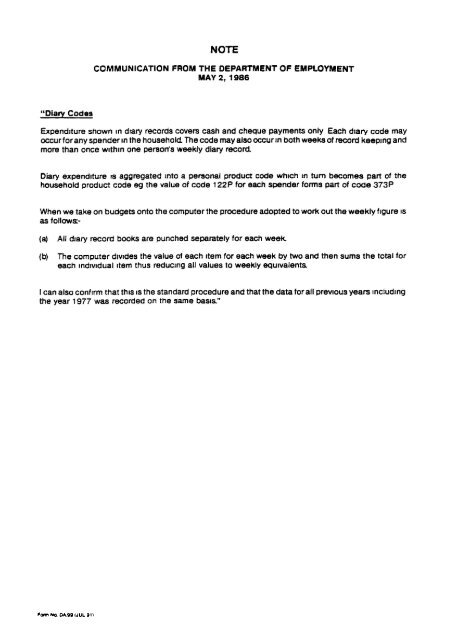

Economic And Social Data Service Esds

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Mortgage Interest Deduction Rules Limits For 2023

The Home Mortgage Interest Deduction Lendingtree